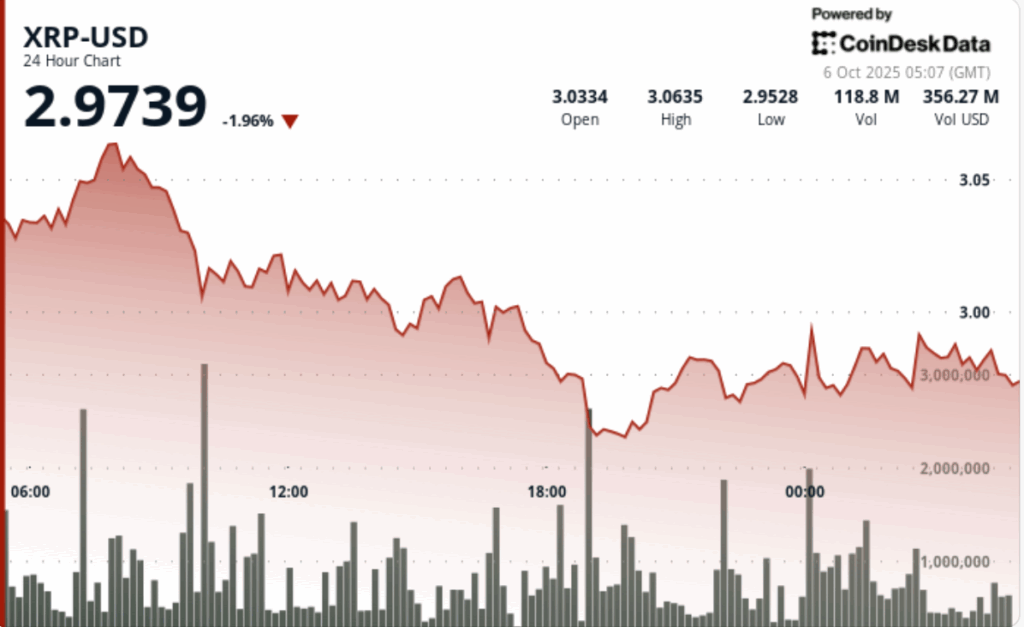

XRP’s early rally to $ 3.07 met heavy distribution on elevated volume, leaving a ceiling and tensile price with a high volume to $ 2.98. Institutional pressure confirmed $ 3.07 as resistance while repeated defense near $ 2.98 held loss contained.

News Background

XRP slipped 1% from October 5, 03:00 to 6 October, 02:00, and withdrew from $ 3.01 to $ 2.98 despite the opening strength.

The token spiked at $ 3.07 in the early hours, only to be exposed to concentrated sales pressure.

Analysts said institutional desks were active in resistance with turnover 17% above daily average. Despite Bearish control through large parts of the session, the XRP ended with a rebound off $ 2.98, which signaled continued accumulation interest.

Summary of Price Action

- The XRP traded a $ 0.09 corridor or 3% intraday interval, between $ 2.98 and $ 3.07.

- The price peaked with $ 3.07 before sharp rejection of DKK 64.3 million. Tokens, against 54.7 m average.

- Sales of pressure drew XRP to $ 2.98, where support was repeatedly defended.

- A dip-session dip triggered a 1.95 m volume flush to $ 2,979 immediately absorbed by buyers.

- Rebound currents stabilized the price near $ 2.98, with recovery quantities an average of 750k per day. Bar.

Technical analysis

- Resistance is firmly established to $ 3.07, validated by sales pressure above average and repeated errors in breaking higher. Support holds at $ 2.98, where buyers consistently entered, including a high-volume flush absorbed late in the session.

- Price action reflects a rejection-driven withdrawal inside a $ 3.07- $ 2.98 ribbon. While sellers dominated two -thirds of the session, the defense of $ 2.98 shows that institutions continue to accumulate on DIPs, keeping the structure intact for another attempt higher.

Which dealers are looking at?

- Whether $ 2.98 applies as support in upcoming sessions.

- If $ 3.07 remains a hard ceiling or weakened under renewed pressure.

- Signs of sustained institutional influxes such as ETF catalysts are approaching.

- Potential test of $ 3.10 if buyers can regain control over $ 3.03.