Dogecoin rose over 7% in the last 24 hours, powered by more than $ 200 million in whale purchases and a sharp uptick in derivatives. Memecoin broke through the $ 0.25 resistance level and triggered a volume -led breakout and sent futures open interest rates over $ 3 billion. Large owner ownership is now just shy for 50%and emphasizes growing institutional participation.

Technical patterns suggest further up towards the area $ 0.27 with bullish atmosphere intact.

News Background

- Whale accumulation crossed 1 billion DOGE -TOKENS (worth $ 200 million) in the last 24 hours.

- Ownership with large foreigners is approaching 50%, a threshold that last approached under previous market tops.

- DOGE FUTURES OPEN Interest exceeded $ 3 billion, indicating a sharp return on geared positioning.

- Wider crypto market strength supported the rally, with a risk entity increased by equity market gains.

Summary of Price Action

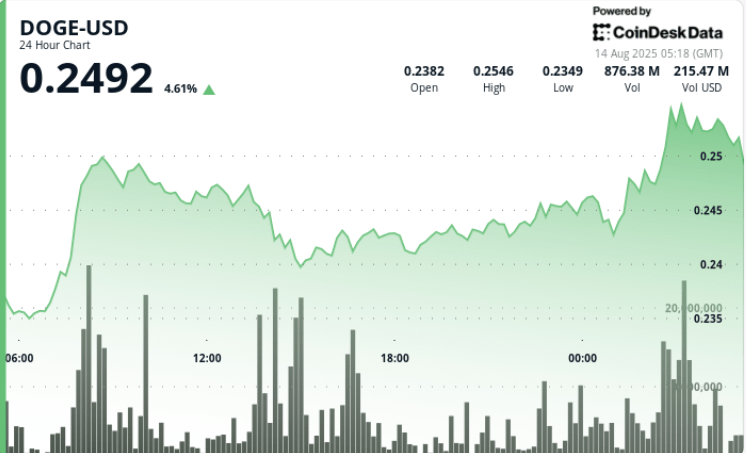

- DOGE gathered from $ 0.24 to $ 0.25 in the 24-hour period from August 13, 05:00 to 14 August 04:00 (+7%).

- Trading Range spans $ 0.24- $ 0.26, reflecting 9% intraday ductility.

- Breakout over $ 0.25 occurred in evening hours after previous consolidation.

- Volume during breakout stages exceeded significantly daily average and topped by 29.2 million in a single minute.

- The last hour showed stabilization of $ 0.25 after a short withdrawal.

Technical analysis

- Breakout from Bullish Flag Pattern Projects short -term goals near $ 0.27.

- $ 0.25 now acts as fresh support after several successful gene tests.

- Resistance is at $ 0.26 with a clean step over the opening path to $ 0.27.

- Volume profile indicates strong accumulation rather than speculative churn.

- Futures OI and Financing Rates suggest sustained long position in the short term.

Which dealers are looking at

- Ability of $ 0.25 Support to keep under any intraday tackles.

- Break over $ 0.26 to confirm the continuation against $ 0.27.

- Whale wallet is flowing for signs of continuous accumulation.

- Financing frequency tips that could signal overflowing along.

- Correlation with wider risk-on movements in shares.