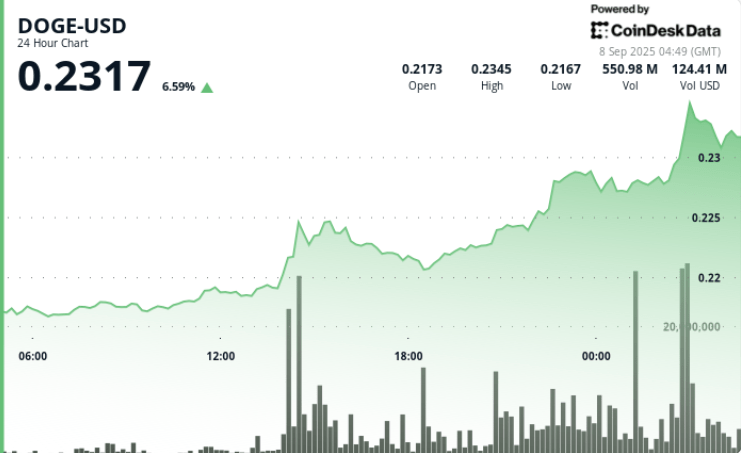

Dogecoin published a controlled increase within a tight intraday band where buyers repeatedly defended $ 0.213- $ 0.214 area and sellers leaning into the zone $ 0.220- $ 0.221. Momentum improved on rebounds where volume rose over session norms, but late momentum faded the price kept attached just under resistance to close.

News Background

- No one confirmed catalyst headings drove the speed. The session was dominated by order-flow dynamics about $ 0.21 support and $ 0.22 resistance.

- Previously references to “All-Time Highs”, ETF archives or Treasury messages were removed due to lack of verification. This reading focuses strictly on observable price and volume behavior.

- Wider meme-coin streams were mixed with rotation clearly intraday, but no sector-covering breakout confirmed by closing strength.

Summary of Price Action

- Traded one ~ $ 0.008- $ 0.010 range, approx. 3-4% turn, with Low near $ 0.213- $ 0.214 and Highs Sondering $ 0.220- $ 0.221.

- The steepest leg lower came in the middle of the session against $ 0.213, where Buying in quicklythat produces a V-style rebound.

- Rebound attempts stopped below $ 0.22With multiple refusals, clusters in $ 0.220- $ 0.221 tape.

- Closing time showed fading momentumLeft the price stabilized just under the resistance and preservation of intraday-higher-low structure.

Technical analysis

- Support: $ 0.213- $ 0.214 is the intraday demand zone. A sustained break during postponing $ 0.210- $ 0.212 and then $ 0.205.

- Resistance: $ 0.220- $ 0.221 remains the immediate ceiling. Above this is reference levels of $ 0.224- $ 0.226 and $ 0.230.

- Momentum: RSI attitude around the mid-50s reflects a neutral-to-Bullish bias without a vibe.

- MACD: Histogram converges against a potential bullish crossover that is consistent with accumulation on dips instead of chasing purchases.

- Pattern: Ongoing Sideways consolidation under $ 0.22. A pure break and hold over $ 0.221 on the expansion of volume would confirm the sequel; The error keeps chop intact.

- Volume profile: Reversal Hounces Printed Relative volume OutperformanceWhile tests for resistance, participation fade, and signal the need for stronger sponsorship to break through.

Which dealers are looking at

- Can Dog close over $ 0.221 with volume expansion. A decisive daily close through resistance would validate a shift from range-bound trade to continuation, opening $ 0.224- $ 0.226 first and then $ 0.230. Repeated errors invite the mean value back against $ 0.214.

- Depth and absorption at $ 0.213- $ 0.214. Persistent rest and rapid recycling behavior supports the bull floor. Thinner books or slower rebounds would warn that demand demand is weakened.

- The quality of breakout if it occurs. Dealers will look for higher heights and higher lowlands on intraday frames, shrink wicks at heights and rising participation rather than a single spikes returning.

- Derivatives attitude. Financing, open interest and long-card couch must confirm spot strength. Rising OI with stable funding is healthier than a crowded long building with prize inviting to press.

- Correlation to BTC and MEME sector width. A BTC push through nearby resistance or wider meme-coin confirmation often improves follow-up. Divergence would temper the expectations.