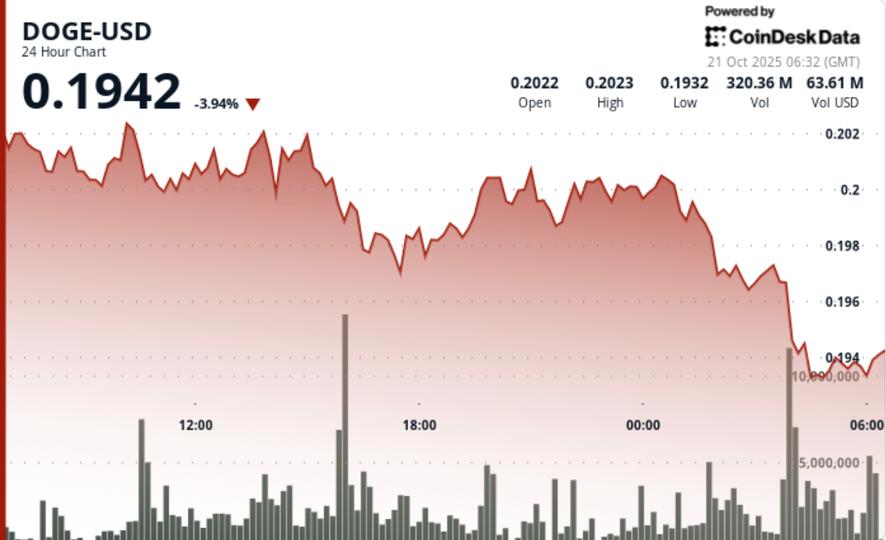

Dogecoin traded heavily into the weekend, falling 3% as institutional desks shed risk across majors. Selling built near $0.20 resistance after several failed breakout attempts, while macro stress keeps traders defensive across alt markets.

News background

DOGE’s retracement follows a week of volatile cross-asset flows triggered by new US-China tariff headlines. Institutional sentiment reversed risk as macro funds reduced crypto exposure alongside a broader deleveraging in altcoin futures. Regulatory overhang from pending US Treasury rules adds pressure as corporate government bonds reduce crypto allocations.

Summary of price action

DOGE traded between $0.204-$0.197 through October 20-21, marking a 3% range on heavy afternoon volume. At 15:00 UTC, 818 million DOGE changed hands – almost three times the daily average – as big sellers capped it above $0.20. The price fell towards $0.197 in late US trade before finding limited support on thin volume.

The last hour (01:10–02:09 UTC) fell another 1% as algorithmic triggers were triggered below $0.20. Volume rose to 40.5 million at the 01:56 print, confirming programmatic liquidation before markets stabilized near $0.197.

Technical Analysis

The structure remains bearish in the short term, while the DOGE is holding below the $0.20 handle. Repeated rejections at that level mark a clear band of resistance, with next support around $0.194-$0.196. RSI and momentum indicators remain negative but approaching oversold; traders note potential pinch risk on any retracement above $0.201.

What Traders See

Desks are watching for signs of stabilization near $0.195 support. A clean demand at $0.201 on volume could trigger short covering at $0.208-$0.21. Failure to defend $0.194 reveals $0.187 – last month’s structural base. The macro mood still controls the direction; any softening in trade war rhetoric could trigger a risk recovery led by DOGE and SHIB.