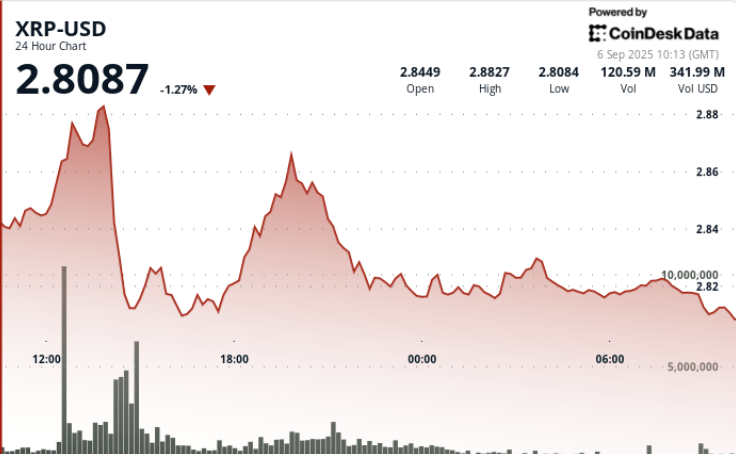

XRP could not maintain momentum over $ 2.88- $ 2.89, triggering a 4%decrease as institutional sales uncovered progress. Heavy volume confirmed resistance at these levels, while buyers reappeared in the range $ 2.81- $ 2.83 to stabilize the price action.

The move holds XRP locked in a 47-day consolidation below $ 3.00, with dealers now looking at the $ 2.77 support man and October’s SEC ETF decisions as the next catalysts.

News Background

- Six institutional asset leaders have submitted SPOT XRP ETF applications, where SEC decisions are expected in October.

- Whale accumulation continues with approx. 340 million tokens purchased in recent weeks despite sustained volatility.

- Exchange balances remain elevated over 3.5 billion XRP, raising questions about potential supply pressure whose sale of resumes.

- Federal Reserve -Political Shifts and Inflation Prints are designed wider liquidity conditions across risk assets.

- Previous attempts to break higher saw 227.7 million token’s trade nearly $ 2.88- $ 2.89, confirming that zone as firm resistance.

Summary of Price Action

- The XRP traded within a range of $ 0.08 from $ 2.81 to $ 2.89, representing 3% volatility.

- The sharpest decline came at. 14.00 on September 5 and fell from $ 2.88 to $ 2.81 of nearly 280 million tokens traded.

- Stabilization followed with consolidation between $ 2.82 and $ 2.83 on lighter volume.

- The closure price near $ 2.82 stored the XRP just over $ 2.77 -Support -pivot, considered the next key -De -dragging railing.

Technical analysis

- Support: Strong Budzone identified at $ 2.77- $ 2.81 after repeated defense.

- Resistance: Instant ceiling of $ 2.88- $ 2.89, with $ 3.00 psychological level and $ 3.30 breakout threshold above.

- Indicators: RSI sits in the mid-50s and reflects neutral-to-Bullish bias.

- MACD histogram converges against Bullish Crossover and signalizes possible momentum change if the volume returns.

- Structure: Continuous 47-day consolidation below $ 3.00 with a close over $ 3.30 opening potential for $ 4.00+.

Which dealers are looking at

- Whether $ 2.77 applies as the crucial support level if you sell CV.

- Price behavior of gene test of $ 2.88- $ 2.89 resistance, especially if volume exceeds daily average.

- How whale accumulation counteracts increased exchange balances, which suggests latent supply risk.

- October SEC decisions on Spot XRP ETFs, considered an important institutional adoption catalyst.

- Macro drivers from FED policy and inflation data releases that may have an impact on streams over digital assets.