International Finance Corporation (IFC), World Bank’s private investment arm, increases stock investments and focuses on large -scale funding of infrastructure in Pakistan.

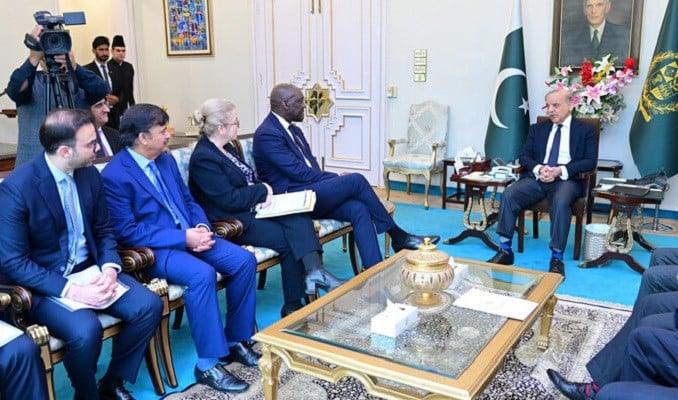

According to IFC manager Makhtar Diop, the investment plan could lock up to $ 2 billion annually in the next decade. Diop’s visit to Pakistan follows the World Bank’s announcement of a country partnership framework of $ 20 billion for the country where IFC matches this allocation.

DIOP emphasized that the annual $ 2 billion investment is not significant for Pakistan, which needs extensive infrastructure development in sectors such as energy, water, ports and international airports.

He expressed confidence that Pakistan’s preparedness within a few months will signal Pakistan’s emergency preparedness to receive large -scale funding for critical infrastructure.

Pakistan, currently under a $ 7 billion Bailout program from the International Monetary Fund (IMF), is navigating in a challenging economic recovery. The country narrowly avoided a status of superb debt, with its reserves insufficient to cover even a month’s import.

IFC’s exposure in Pakistan reached a record $ 2.1 billion for the financial year 2024. Diop highlighted IFC’s interest in sectors such as agriculture, infrastructure, finance and digital industries in Pakistan.

In addition, DIOP noted that stock -based transactions will play a greater role in the country’s development as IFC increases its stock investments globally, including in Pakistan.