Market participants appeared to be focused on liquidity conditions and risk reduction, with selling pressure intensifying around previously well-defined support levels.

News background

- XRP traded significantly lower in the recent session as broader crypto markets faced renewed risk-off pressure.

- Despite continued spot ETF inflows over recent weeks, short-term price action has been dominated by technical positioning rather than fundamental development.

- No single catalyst drove the move.

- Instead, the decline reflected positioning adjustments across majors, with XRP showing relative weakness compared to peers as supply emerged in rallies.

Technical analysis

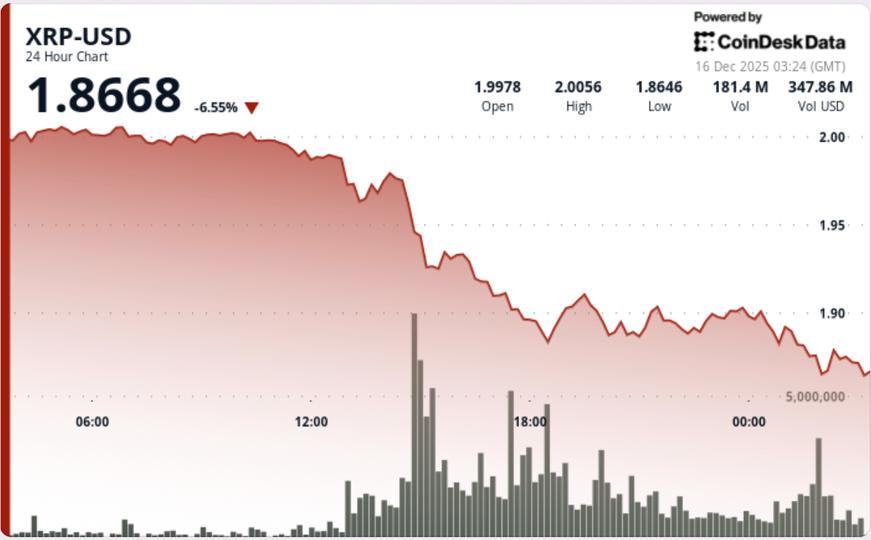

- XRP decisively broke below the $1.93 support zone, a level that had held through several tests in recent weeks. The collapse coincided with a significant increase in trading volume, indicating participation from larger market participants rather than thin, illiquid trading.

- Total session volume reached approximately 191 million tokens, about 246% above the 24-hour average. The biggest activity coincided with the move through $1.93, confirming acceptance below this level.

- On lower timeframes, price action remained limited below $1.88, which now acts as near-term resistance.

- The structure on the hourly chart remains bearish, with lower highs and limited follow-through on minor rebounds. Momentum indicators remain compressed, suggesting that the selling pressure has not completely dissipated.

Price action overview

- XRP fell from just below $2.00 to a session low near $1.87

- The $1.93 level failed quickly when first tested without a sustained bid response

- The price briefly consolidated between $1.86-$1.88 after the crash

- Volume remained elevated to the end, signaling an ongoing repositioning

Volatility grew significantly, with XRP trading with a wide intraday range compared to recent sessions.

What traders should know

- $1.93 has moved from support to resistance and remains a key level to watch

- Sustained trade below $1.88 keeps downward pressure intact in the near term

- $1.85 is the next meaningful area where buyers can try to stabilize the price

- Any recovery attempt is likely to require a $1.93 clawback on declining volume to signal reduced distribution

- Until that happens, XRP remains technically vulnerable, with price action driven more by flow and positioning than by long-term accumulation signals.