Dogecoin traded flat after the Federal Reserve delivered a widely expected rate cut and held key support as traders assessed what easier policy means for risk assets.

News background

- The Federal Reserve announced a 25 basis point cut in its benchmark interest rate on Wednesday, lowering the target range to 3.5%-3.75%.

- While the move marked the third cut of the year, policymakers signaled growing internal discord.

- Some members supported further easing to protect a weakened labor market, while others warned that further cuts risk reigniting inflationary pressures.

- The mixed tone limited immediate risk follow-through across markets, with crypto prices stabilizing rather than extending gains.

- Against this backdrop, Dogecoin continued to see steady engagement on the chain.

- Whale wallets accumulated around 480 million DOGE over the past few sessions, and trading activity remained high following the launch of spot DOGE ETFs from Grayscale and Bitwise.

- However, ETF-related flows have thus far failed to produce sustained directional momentum.

Summary of price action

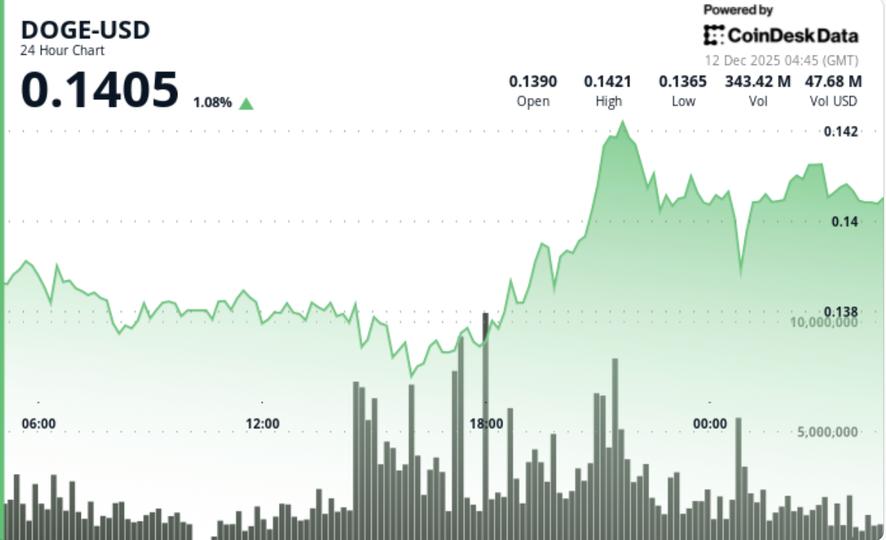

- DOGE rose 0.69% to around $0.1405 over the past 24 hours, staying firmly within its multi-week consolidation range of $0.13-$0.15.

- The price moved between $0.1382 and $0.1408 during the session, reflecting subdued participation despite the macro catalyst.

- Trading volume reached approximately 651.7 million tokens, about 7% above the seven-day average, suggesting positioning rather than aggressive accumulation.

- Repeated attempts to clear resistance near $0.1425-$0.1430 were rebuffed, while buyers continued to defend the $0.1380 area.

Technical Analysis

- Technically, DOGE remains in a compression phase. Horizontal support near $0.1380 has now held through several tests, reinforcing its importance as a short-term floor.

- Momentum indicators remain neutral, consistent with range-bound conditions rather than trend development.

- The structure continues to resemble a pennant or volatility coil, meaning that a sharper move is more likely to come from a breakout or breakdown than gradual drift.

- Until the price regains the upper boundary of the range, upward attempts are likely to face selling pressure.

What traders should know

- With Fed tapering now priced in and policymakers signaling uncertainty about further easing, DOGE appears to be more sensitive to broader risk sentiment than to token-specific catalysts.

- Holding above $0.1380 keeps the structure intact, but failure to regain $0.1420-$0.1450 suggests upside remains limited for now.

- A sustained break above this zone would open the door towards $0.16-$0.18, while a loss at $0.1380 would reveal the lower end of the range near $0.13.

- For now, DOGE remains a consolidation trade in a post-Fed wait-and-see market.